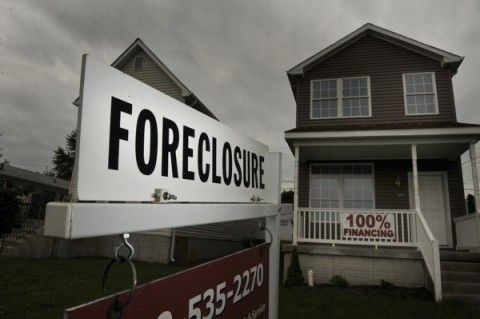

Why Obama's Anti-Foreclosure Program is Failing

President Obama's Home Affordable Modification Program (HAMP) isn't effective. Here's why.

The Home Affordable Modification Program, which modified loans for eligible homeowners facing foreclosure, is not only failing to make things better for those who stand to lose their homes, it's actually making things worse. Recent news reports have revealed that many homeowners' mortgages are higher than they would have been had they not entered into the program.

That wouldn't be a problem if the homeowners didn't also have less equity. According to the Treasury Department, more than 1 million people are 60 days delinquent on their mortgage, thus eligible for HAMP, yet less than 650,000 homeowners are in the loan modification program.

In 2009, Obama’s $75 billion dollar HAMP plan was set up to keep families in their homes by using a mix of incentives for banks to refinance mortgages, and for homeowners to make reduced payments. Touted as a way to help up to five million homeowners, the plan would refinance home loans, provide $2 billion in rental assistance, and stabilize the housing market. The plan sounded as though it was heaven sent, but instead it’s been hampered with problems that have made it less than effective for many homeowners.

The problems are many, but the three biggest are:

1. The Obama Administration acted as if it thought the HAMP program alone could fix the mortgage crisis when the real issue was jobs.

“The Obama Administration's attempt to start new programs to rent or make it easier to purchase Fannie Mae homes proves they are missing the point,” says Harold Durant, CEO of Omni Title and Acquisitions, Inc., a commercial and residential acquisition firm headquartered in Orlando. “The Administration has failed to address the root cause of the foreclosure explosion: jobs. When people can't find work, the amount of their mortgage or interest rate is irrelevant.”

Aside from the stimulus there weren’t any other programs that addressed long-term unemployment. And it is largely these folks who have the hardest time paying their bills and keeping their homes.

2. It put far too much responsibility in the hands of banks.

“The HAMP program had its hugest impact on the finance industry,” says Ali M. Faruk, director of housing policy and research at Housing Opportunities Made Equal, a housing advocacy organization in Richmond, Va. “To keep from having to participate in HAMP, all the mortgage companies created their own versions of HAMP so they could have more flexibility. They then funneled homeowners into their own loan modification programs. The end result was that homeowners got a lot of help because the creation of HAMP by Obama really spurred the mortgage companies to take ownership of the problem.”

It is true that banks have taken more ownership to a certain extent. But their collective responsibility has only extended so far. It hasn't stopped them from lying to credit reporting agencies about which homeowners have paid their mortgages and which have not. Clearly the HAMP program wasn't made to tackle that. In fact, there's a separate ongoing settlement on the table between all 50 states and the major mortgage banks.

3. It didn’t have a strong enough qualification process, and it has not enrolled enough homeowners.

Recently the New York Federal Reserve published a report comparing the federal foreclosure prevention plan to Pennsylvania’s Homeowners' Emergency Mortgage Assistance Program (HEMAP). Even though the national unemployment rate was similar to Pennsylvania's (where the rise in housing prices was more acute), the percentage of seriously delinquent mortgages was far lower. Granted, the HEMAP program is 27 years old and nearly 76% of its applicants are rejected.

But the program has tight qualifications because it seeks to provide help to those best able to keep their home (with just the right amount of temporary support). For instance, 80% of HEMAP loan recipients have been able to keep their homes. That's a far cry from what Obama's HAMP program has done. 40% of HAMP borrowers were kicked out of the program in its first year. And the remaining borrowers weren't likely to receive permanent modifications, just temporary ones.

Why doesn't the Obama Administration just replicate HEMAP on the federal level or induce states to create similar programs nationwide?

On average, foreclosures are taking nearly 100 days longer than they took last year. That may sound good but it isn't. The best way to help the housing market is for those who have no means to pay the mortgage -- whether they be speculators, investors, or regular folks with just too little income -- to give the keys back to the bank as quick as possible, thereby allowing a quicker sale and an opportunity for the bank to earn something.

Originally Posted at Loop 21.