Signs of Good News in the Recovery

The economy is currently very weak, but as I write in my column for The Week, there are some signs of good news.

It's been a summer of bad news: Bad job news, bad housing news, bad Iraq news, bad Libya news, bad news on the Euro and the debt ceiling and — OK, let me change the subject to the good news. Because it exists, too.

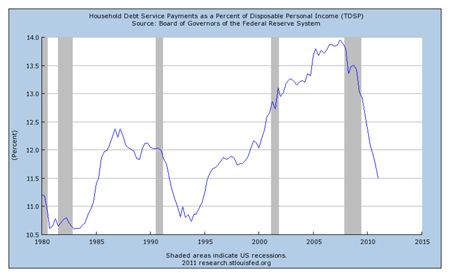

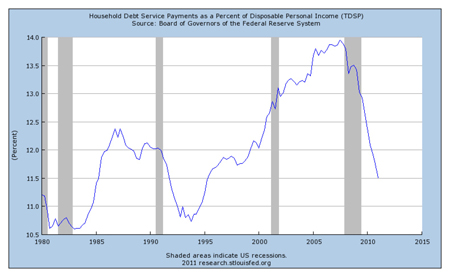

1) Americans are pulling out of debt. Before the recession, households were spending 14 cents out of every after-tax dollar to service their debts. Today debt service costs 11.5 cents — and still plunging. Americans have not spent this little on debt since 1995, and at the rate things are going, it won't be long before households have de-leveraged themselves back to where they were in 1980.

Check out this chart, which maps household debt service payments as a percentage of personal income over time.

Indeed, as Fed Chairman Ben Bernanke testified to Congress on Wednesday:

"[D]elinquency rates on credit card and auto loans are down significantly, and the number of homeowners missing a mortgage payment for the first time is decreasing. "

Americans' credit problems are turning around.

2) Exports are surging. The U.S. sold $175.6 billion of goods and services abroad in April 2011, a record. May was not quite as good of a month as April, but still, altogether, the U.S. has exported 25 percent more over the past 12 months than it did in 2009. If current growth trends hold, by 2014, the U.S. should sell twice as much abroad as it did in 2009.

Increasingly, America is financing its purchases from the world with sales to the world, rather than through borrowing.

Click here to read the full column.