Want Big Budget Cuts? Weaken the Dollar

Republicans promise that rapid action to cut government spending will lead to a quick return to prosperity.

They have some evidence on their side: the experience of some small countries that used these methods back in the 1990s (Finland, Ireland, Netherlands, New Zealand, Norway and Sweden).

Republicans could cite another example, a bigger economy more similar to America's: Canada. Canada cut spending in the 1990s, balanced its budget, and ignited rapid economic growth.

But here's the problem: Canada and the six small countries cited by Republicans all allowed their currency to depreciate deeply. The cheaper currency triggered an export boom, and since these economies were small and depended heavily on foreign trade, the export boom translated into more activity throughout the whole economy.

The cheap currency was essential to reinvigorate each economy.

Canadian economists admit to this even while they insist they don't advocate a weak currency as policy. Ross Laver, Vice President of Policy and Communications of the Canadian Council of Chief Executives, explained some of the benefits of a devalued currency: “To the extent that a weak currency helped exports – well, yes, that encouraged economic growth which in turn led to higher government revenues.” He made clear that the government did not seek this: “But that weak currency was imposed on Canada by international markets – it wasn’t something we went looking for, or for that matter celebrated.”

It may not have been a “deliberate strategy” but there is no denying that the policy helped.

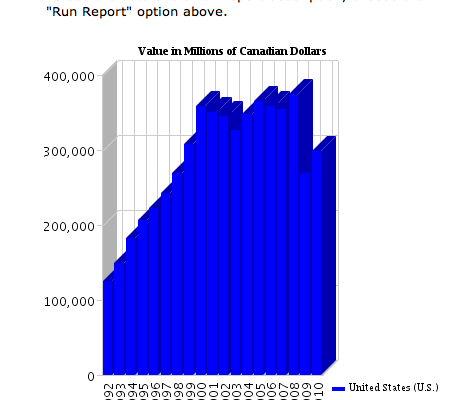

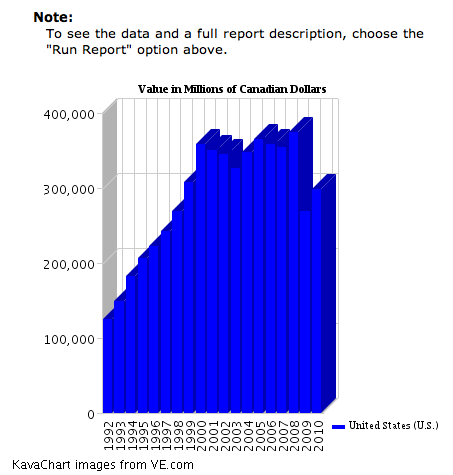

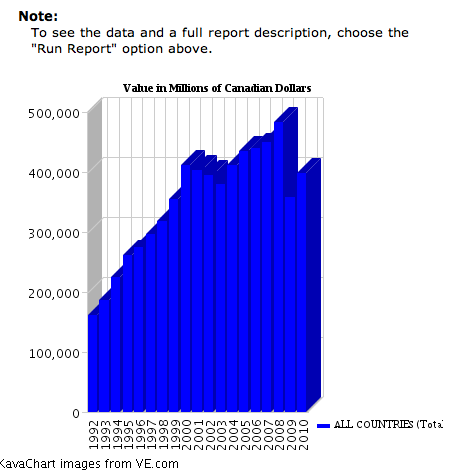

The following is data on the volume of Canadian exports courtesy of information from the Canadian government. [The data only goes back as far as 1992.]

It shows a significant increase in exports from Canada to both the United States and to all countries globally, which can at least in part be attributed to the weak currency in the nineties.

However, it is questionable whether the larger and less trade-reliant US economy can benefit as much from rising exports as Canada did, let alone Finland. In the nineties Canada’s currency was cut by a third to instigate the export boom (90 cents on the dollar to 60). Given that the US economy is even bigger than Canada’s and the percentage of exports is smaller, one wonders how weak the dollar would have to become before we would see real change.

Republicans, however, demand a stronger US dollar at the same time as reduced government spending. This would mean that there would be no export boom at all while the government would be withdrawing its purchasing power from the domestic economy.

This certainly raises questions about whether implementing the Republican approach is necessarily the best way to balance our budget, or whether it would even work at all.

Tweet