America's Private Debt Binge

Americans are quick to criticize wasteful government spending, but since the 80s our debt load has been overwhelmingly private.

Americans are quick to criticize wasteful government spending, but since the 80s our debt load has been overwhelmingly private.

Is public spending stimulative? Is private spending stimulative? The dichotomy in my opinion comes very close to being a false one. Another dichotomy might be more important.

The argument that public spending isn't stimulative, so far as I can tell, often falls to the same economist, Harvard’s Robert Barro. The Wall Street Journal often cites Barro alone, for example, to support an argument that the multiplier on government spending is less than one. I would be open to other citations, but Barro’s particular argument in my opinion doesn’t withstand scrutiny whatsoever. If Barro’s is the only empirical data that can be dredged up to support the point, that suggests a potentially significant problem with the argument from an empirical perspective. (Here is my argument against Barro, posted some time ago.)

On this topic, my mind wanders immediately to my time in Taiwan in the mid 1980’s, and my travel on the magnificent cross-island highways built end-to-end and dissecting the country in response to an urgent need for defense. The harrowing bus rides across gorges were the memorable part. But more importantly, all the work done on Taiwan in establishing its highway systems so that troops could be moved, where previously the island could be not traversed, surely paid important economic dividends throughout the decades. They tied together the cities with each other, the coasts with the coasts, and the interior with the coasts, and fostered an immense amount of economic development. The same might be said, of course, for our own interstate highway system, which I understand was constructed with a similar purpose originally. Indiana early on immediately established public schools… that too surely was stimulative. I would be interested in (and startled by) arguments to the contrary.

But we can agree that there is such a thing as wasteful spending, spending which produces no enhanced future return for our society, especially that spending which is wholly debt-financed with no hope of enhanced productivity to pay it off. Whether that spending is public or private is beside the point.

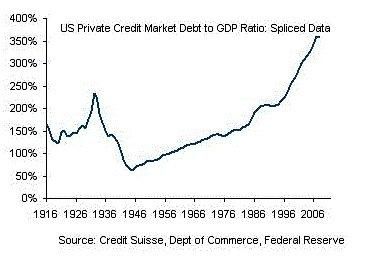

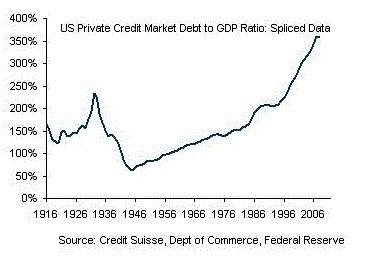

The following graph, not in any way an original one, but one with which I suspect many Americans are unfamiliar, shows our national debt, public and private, as a percentage of GDP:

From the graph, we can see the staggering debt load our society developed which took off in the early 80s, a debt load which was overwhelmingly private. It is an embarrassing graph for a Republican. Some critics attribute the sky-rocket in societal debt to bank deregulation, securitization of debt, and then the absence of serious regulation in the area of securitization, not to mention government spending and receipts out of balance.

And what was this private debt buying? To a significant degree, it was buying consumer goods and experiences (flat screen televisions in every room, Caribbean cruises, and homes with large and often unnecessary rooms full of furniture not sat upon) which, while adding to the material quality of life (though, studies show, not its emotional quality) do virtually nothing to enhance future productivity. So we are forced to become apostates in the faith of private vs. public prudence. While we prefer the private sector to allocate resources, we have disconcerting evidence that prudence in the private sector is no more impressive than that in the public.

Stripped of our pronouncements on behalf of the faith, then, we should for a moment forget about who is borrowing the money. The answer to that question, whether the debt is public or private, is always that we are borrowing the money. Instead, we should focus on what we are, and should be, spending our money on. Do Americans in particular want to be spending money on flat screen televisions manufactured abroad? Or on education of a workforce that can compete globally; on the means of connecting that workforce with its workplace and its products with the world; on research and development; and other productivity-enhancing objectives for our society?

If we are cutting public funding for higher education or transportation infrastructure, in order to provide tax cuts to be spent privately on flat screen televisions or their equivalent, then the net effect strikes me as undesirable. And if we are encouraging the accumulation of debt, whether publicly or privately, without enhancing our means of satisfying it, that too strikes me as undesirable.

Tweet