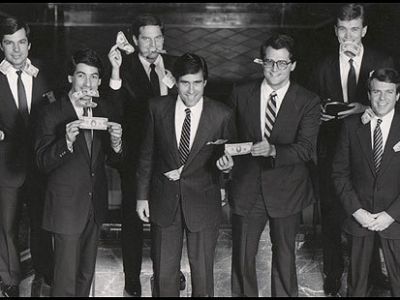

Wall Street Ties Won't Sink Romney

Some on the right are concerned that Obama would slam Romney as a denizen of Wall Street and that Romney's wealth would prove a hindrance in the general election. While some worries about Romney's business background are more the product of sympathy for other candidates than anything else, there …