The Next Economic Crisis

A more immediate threat to the global economy than the China-U.S. payment imbalance problem is the large current account and budget deficits characterizing the Greek, Irish, Spanish, Portuguese and Italian economies. It is very difficult to see how these imbalances get resolved within the straightjacket of Eurozone membership, which precludes these countries from using the exchange rate as a means to stimulate their export sectors.

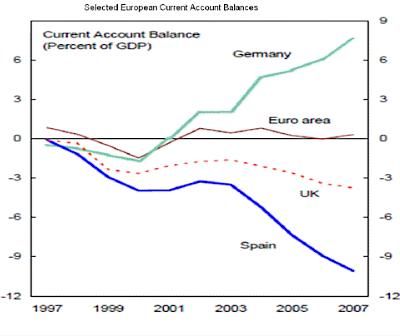

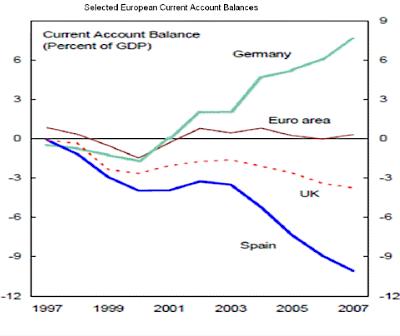

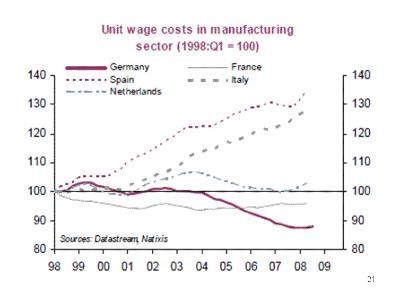

As you can see from the chart below, since the Euro’s inception in 1999, Italy and Spain have lost more than 40 percent in international competitiveness with respect to Germany. It is little wonder then that one sees Germany running current account surpluses close to 8 percent of its GDP at the same time that Spain runs current account deficits approaching 10 percent of its GDP. If ever there was an unsustainable payment imbalance problem this has to be it.

Expect the difficulties in Greece, Ireland, Spain, and Portugal to be a major focus of global markets in 2010.