Steuerle: Soc Sec's Trust Fund Isn't the Solution

Eugene Steuerle of the Urban Institute writes:

Once again, policy-watchers and policymakers are fired up over whether Social Security needs to be fixed anytime soon. Some resort to pretty arcane debates over the trust fund to make their point. Won't it take years to exhaust the trust fund? Are the bonds in the trust fund real? Is the trust fund a fiction? Was the trust fund raided? You know, it scarcely matters. All these debates are over a tiny sliver of the Social Security System—not over where the real action is.

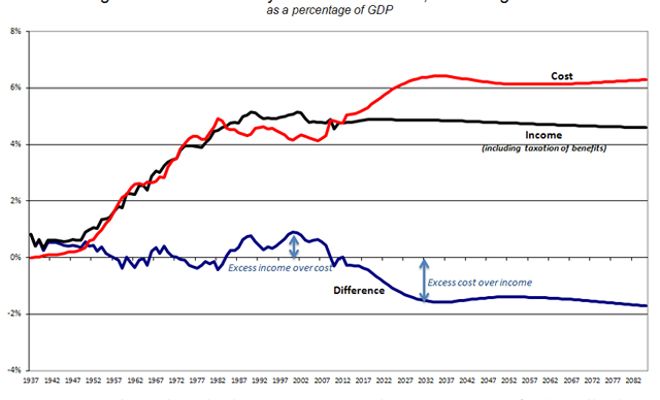

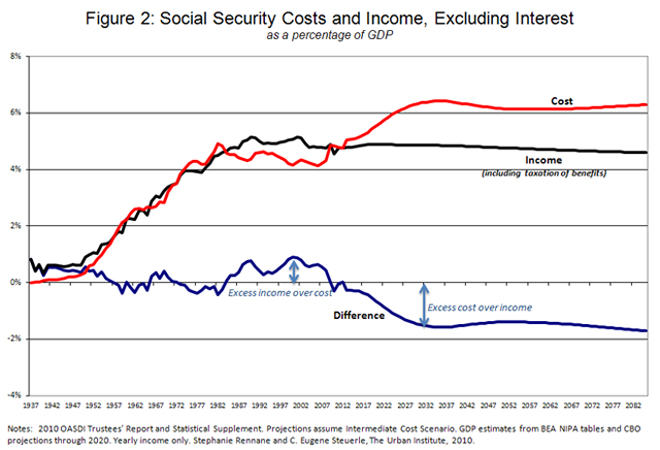

What does matter is that Social Security expenses are expected to rise by about 50 percent—from about 4.3 to 6.3 percentage points of GDP—from 2008 to 2030, and taxes aren't. As the baby boomers retire, higher expenses and less tax revenue mean that the national deficit will rise year after year.

Let's take a quick look at the history of Social Security expenses and income. As the figure readily shows, Social Security has always been roughly a pay-as-you-go system. There was a tiny buildup of the trust funds at the beginning when people paid into the system but beneficiaries had not become eligible. In most years, the trust fund's purpose was simply to cover potential cash flow problems if a recession or other major economic event hit. Then, in the mid-1980s, there was a slight buildup again as the large cohort of baby boomers swelled the ranks of the working population. But never have these trust funds held enough money to cover more than a tiny fraction of Social Security's obligations.

Those who say we can wait 20 years to address Social Security's solvency even though the system will soon be spending over 30 percent more than it collects in taxes have turned a blind eye to current and growing deficits. They seem to think that (1) we can count on income tax payers to raise more taxes, or we can cut other spending, or we can borrow more and pay interest to the trust funds as they move toward decline; or that (2) we can draw down assets (say, by borrowing more from China to pay off bonds in the Social Security trust fund) without consequences.

This is the mindset of a household that has saved $50,000 for retirement but has $300,000 in credit card debt and keeps charging more every year without paying down the balance. The parents in such a household plan on retiring for decades, earning less, and spending down their meager retirement savings in a few years, so they're counting on their kids to bail them out. The parents keep insisting that the assets in their "fund" were real. The kids think the retirement fund is an accounting fiction. The parents remind the kids that they'd be in a worse pickle if it weren't for the parents' retirement fund. You can see how fruitless this conversation is when the operative fact is that the household is in a big financial hole that the decline in income and increase in expenses will only deepen.

How about raiding the trust fund? Those railing against this financial sin say that the country would have been better off without running a lot of non-Social Security debt even while it was accruing a tiny pot of money temporarily in its trust fund. That's true, but then whose taxes were lower and other government benefits higher as a result? Often, the same people who cry foul that the (tiny) trust fund was raided. By that bizarre logic, the parents in our hypothetical household could claim that the kids should support them in retirement because the parents had raided their retirement fund by running up credit card debt. ...

Click here to read the rest.