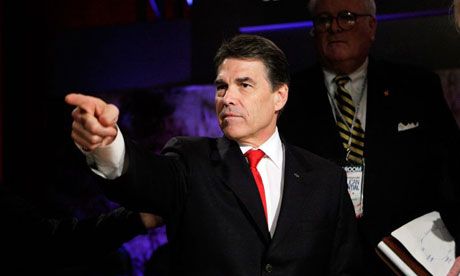

There is Nothing Simple About Perry's Tax Plan

Rick Perry's proposal to make his flat-rate tax plan optional seems like a political master-stroke: it lets him propose the type of flat-rate, broad-based tax plan that most economists like while simultaneously promising that nobody will need to pay more.

Nice as this sounds, however, it actually undermines the simplification that is supposed to come from a flat tax.

The Perry Plan, by its very nature, actually increases compliance costs. Everybody will have to fill out two complete tax returns: one under the current system, the another under Perry's new system. (They'll only file whichever one shows the lower liability.)

Base broadening, the crux of Ronald Reagan's 1986 tax reform, is also absent: nobody who avoids all (or almost all) taxes today will have to pay them. Not a single individual or corporation that gets off without taxes today will pay a penny more.

The plan also seems unlikely to do much for investment. Although lower taxes, all other things being equal, will encourage more investment, the flat corporate rate of 20 percent is actually only a smidgen lower than the median "effective" rate of 22 percent that PricewaterhouseCoopers found in its extensive international comparison of corporate tax structures. Most business enterprises won't see a big enough cut in taxes to consider the U.S. a much better place to invest.

The only real winners under the Perry plan seem to be very high income individuals who earn $700,000 per year and up and therefore have most of their income taxed at the 38 percent rate. They'll end up a lot better off. The rest of the world--including most businesses--don't really get much at all out of Perry's plan.