More Problems with Cain's 999 Plan

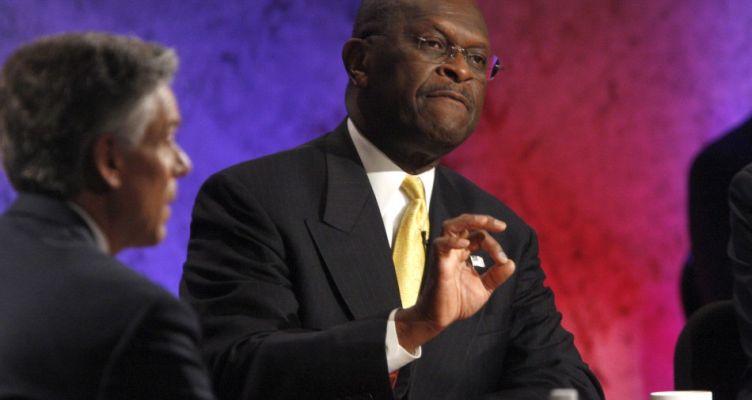

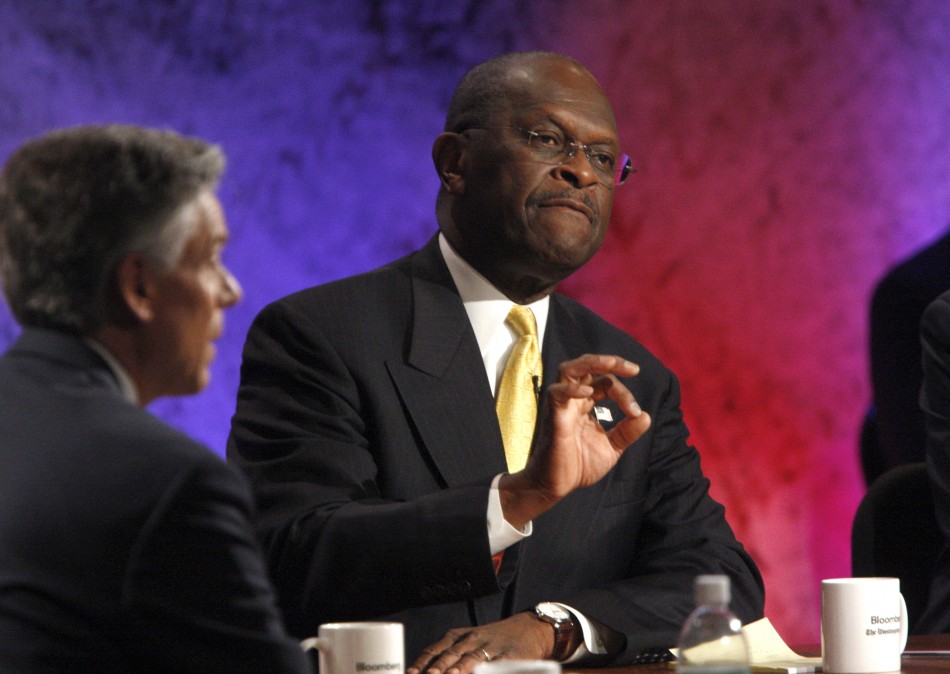

There is so much to like about Herman Cain.

And there is also his 999 plan. Mr. Cain's website states that "Amidst a backdrop of the economic renewal created by the 999 Plan, I will begin the process of educating the American people on the benefits of continuing the next step to the Fair Tax." While there is no legislation to study with respect to his 999, there are some clear economic and political problems with 999.

Like the FairTax proponents, Mr. Cain infers a reduction in prices partially or totally offsetting the increased tax rate. He looks to the decrease in the corporate tax rate and the elimination of social security taxes on payroll for employees to cause this price reduction.

One need only look to the annual report of Safeway to understand the impact of 999 on grocery prices. Because the grocery business is incredibly efficient and there is significant competition, there are very, very low margins in the industry. The pretax profit in good years for Safeway is only about 2% of sales and the Federal income taxes therefore are less than 1/2% of sales. After making a reasonable guess based on other information in the Safeway annual report, the total Federal income tax plus Safeway's portion of their employees' payroll taxes is less than 2% of sales. Assuming that would all be passed through to the customer in the way of price reductions, the price of food must increase by about 7%.

An immediate increase of 7% in food prices or the mere thought of this could destroy any chance Herman Cain has with retired and low income voters. As this voting block does not pay income taxes, the resultant reduction in their spending power would surely result in these voters looking elsewhere.

In addition, assuming that the 999 parallels the FairTax, there are questions to be posed. It appears that many of the problems that we noted in The FairTax Fantasy, An Honest Look at a Very, Very Bad Idea would or could accompany the 999 plan. Because Mr. Cain wants to educate voters on the FairTax, the following questions need to be asked of Mr. Cain immediately:

1. The FairTax proposal, if calculated as a traditional sales tax, is 30%, but is described as a 23% tax because it is calculated on a "tax-inclusive basis". (Note, the FairTax rate of 23% results in a tax of $30 if the seller gets $100 in sales proceeds. There is no controversy with respect to this calculation.)-- Question 1: Is the 9% sales tax calculated in the same manner as the FairTax? If so, if stated like a sales tax, the rate is actually 9.89%.

2. What is not taxed under the 999 plan? The FairTax taxes new houses, food, and all services, including rent. Does the 999 plan follow the FairTax and tax each of these items?

These and other questions regarding the 999 plan need to be addressed.