Laffer: Soaking the Rich Won't Cut It

In an interview with FF, economist Dr. Arthur Laffer argued against letting the Bush tax cuts expire and explained how higher taxes on the rich alone reduces revenue.

In an interview with FF, economist Dr. Arthur Laffer argued against letting the Bush tax cuts expire and explained how higher taxes on the rich alone reduces revenue.

In a podcast with FrumForum, economist Dr. Arthur Laffer – author of the Laffer Curve, criticized President Obama’s plan to let Bush-era tax cuts expire on the rich while keeping tax cuts for lower-income groups. Laffer urged just the opposite: keep tax cuts on the rich, and raise taxes on lower- and middle-income groups.

“The one tax cuts that they aren’t going to extend are [for the rich]! And they’re going to lose buckets of money, and they’re going to cause the economy to be a lot worse,” argued Dr. Laffer. “If you want to raise money, you gotta tax lower and middle income people.”

Laffer explained that higher-income groups were more adept at avoiding taxes, and that higher taxes on the rich would actually increase the deficit.

“Rich people are far more sensitive to tax rates than are lower or middle income people. If you raise tax rates on the rich, you really will collect less revenue… Not because I want it to be true, it is true,” argued Dr. Laffer. “It’s clear that tax rates on the very highest income earners really work perversely. Rich people can hire lawyers, accountants… [and have] the ability to change the location of their income, the timing of their income, the composition of their income, the volume of their income.”

Asked if tax rates on lower-income classes would hurt the poor, Laffer said, “In their terms, [this plan] clearly is regressive. But it increases output, employment, production and jobs. And the best form of welfare is still a good, high-paying job.”

FrumForum also asked Laffer about the common Republican implication that reducing taxes will always increase revenue. “Well, that’s not true,” responded Dr. Laffer. “But the people who are proposing tax structures which are way too low are not the problem today… The tax structure that we have right now, and that this administration and the previous administration has put into place… have made it very difficult to have prosperity.”

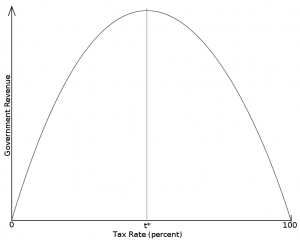

Absolutely fundamental to an understanding of the Laffer Curve’s public policy implications is estimating the economy’s position on the curve. On the right side of the curve (see figure below), cutting taxes will raise revenue. On the left side, cutting taxes will decrease revenue. So how do we know where we are on the curve?

Laffer admitted that estimating positions on the Laffer Curve is a tough thing to do, but suggested three factors that would be helpful indicators:

- The higher tax rates are, the more likely that tax increases will reduce revenue.

- The longer you’re willing to wait before implementation of the tax raise, the more likely that tax increases will reduce revenue.

- The smaller the targeted tax base is, the more likely that that tax increases will reduce revenue.

This is part one of a series on discussions with Dr. Arthur Laffer. Still to come: his feelings on President Barack Obama, his support of a revenue-neutral carbon tax, and what can be done to bring America back to prosperity.

Add me on twitter: www.twitter.com/timkmak