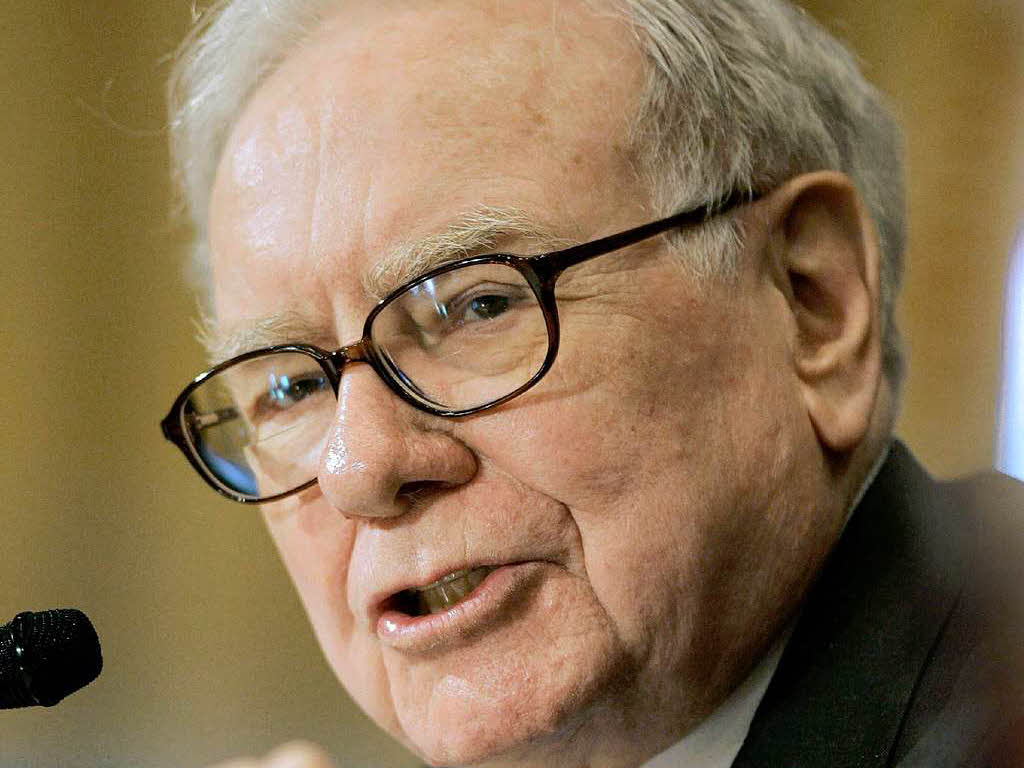

Just What IS the Buffett Tax?

Great novelists create characters that give each reader the opportunity to create their own vision of their appearance. The heroine may have dark hair to one reader and be a blonde to another. At the moment, the “Buffett Tax” is the stuff of great fiction. The rate and the calculation are in the eyes of the beholder.

Is it a Steve Forbes-like flat tax at 25%? Is it the elimination of the capital gains tax rates or elimination of the dividend tax rates which are already scheduled to increase in 2013 (capital gains from 15% to 20% and dividend rates from 15% to 39.6%)? Is it the entire elimination of itemized deductions unless the overall tax rate is at a certain tax rate or higher?

This is brilliant politics because the Buffett Tax is impossible to analyze or explore without specifics.

The American Jobs Act does present some specifics that can and should be analyzed within the framework that lower rates for specific actions and itemized deductions are in the current tax code to impact behavior. When these laws are changed, for good or bad, existing behavior will change accordingly. That is a fact, not a postulate.

A few examples: (1) If the value of the itemized deductions for charity is reduced, there will be less giving, (2) if interest received on state and municipal bonds becomes fully taxable, interest rates being paid by states and cities will go up costing the citizens of those states and cities by increasing borrowing costs, & (3) reducing the deductibility of certain costs in drilling for oil will increase the cost of producing oil and raise the price of gasoline.

As to the “Buffett Tax”, the President needs to put some flesh on the bone of the proposal and explain in detail what he has in mind. Until then, it is politics 101. For all anyone knows that this point, it could be a great idea or not.

As to the American Jobs Act proposals, Congress needs to take time to evaluate each precise proposal and determine if the increased revenues are more important than the impacts of the economic decisions that will be made by the impacted taxpayers. It is their job to think through the impacts of any proposed law, regardless of whether the proposal is coming from the President or another member of Congress. And, great minds can differ on what is a great idea.