Gold: Good For Nothing

Brad Schaeffer is right: Numbers don't lie. And the numbers on gold are pretty clear: it's a lousy investment over any long period of time. In times of economic uncertainty and malaise (whether it is now or the 1970s) gold prices have indeed gone up rapidly. (Just like dot.com stocks or real estate did.) But these prices came crashing down in the 1970s and will again. And they should.

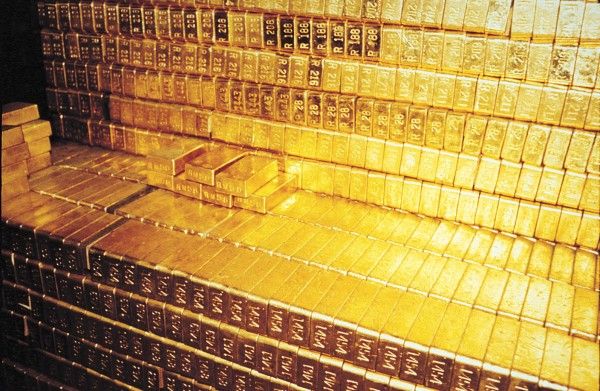

As I've said before, gold is, quite literally, good for nothing: it has no significant industrial uses (yes, it's used in some electronics but there's enough in a mall jewelry store for an entire year's worth of iPhones) and can't actually be used to buy anything either. Speculators can, indeed, get rich on gold but they need to figure out how to time the market. And nobody has ever devised a market-timing strategy for anything that works prospectively. (A retrospective one, of course, is quite easy.)

Equities, bonds and even bank deposits both give their buyers a claim on real revenues, taxes, and capital appreciation. Purchases of commodities other than gold and silver give people a claim on inputs of real economic relevance. Buying gold simply gives someone a shinny, heavy material. In fact, the chance that gold might one day be worth essentially "zero" are infinitely greater than almost any other asset class hitting that value: gold is already more volatile than these assets. Broad indexes of stocks and bonds, like gold, have also never been worth zero and, because they have something underlying them, their chances of hitting zero are a lot smaller. If a collapse took place, say, caused by a default on U.S. government bonds and the bankruptcy of all major corporations, commodity crops and fuels--not gold--would still retain value. The price of gold simply reflects' investor uncertainty.

In light of all this, it's worth noting that I own shares in the exchange traded fund GLL which continually shorts gold. So far I've lost money. In the long term, I'm pretty sure I'll do very well on it.