Fannie and Freddie's Subprime Loan Purchases Add Up to Trillions

At Thursday’s Senate Banking Committee hearing on the future of Fannie and Freddie (the GSEs), Senator Menendez asked Edward DeMarco, the acting director of the Federal Housing Finance Agency what role the GSEs played in the housing crisis. Mr. Demarco responded that both had significant and active roles in the subprime private mortgage backed securities (PMBS) market. He added that with respect to the purchase of whole loans, both GSEs purchased substantial volumes of loans with subprime characteristics, even though neither classified them as subprime at the time. Mr. DeMarco indicated that he would need time to get back to Sen. Menendez with a detailed answer to his question.

I am pleased to be able to provide both Sen. Menendez and Mr. DeMarco with the results of my research regarding the Senator’s question.

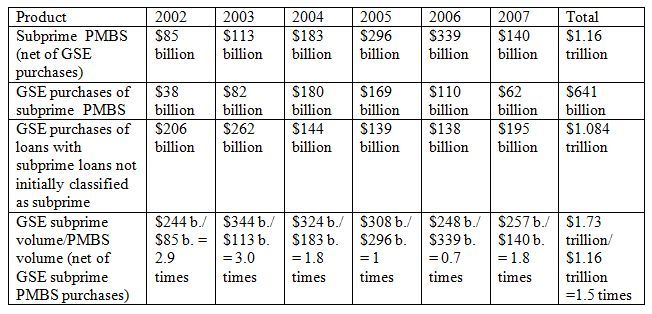

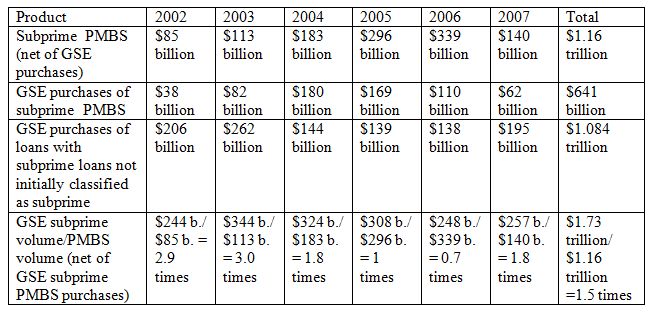

Below is a table setting forth the GSEs’ subprime loan and securities purchases (regardless of their initial classification):

Sources: Inside Mortgage Finance, FHFA, Fannie Mae, Freddie Mac, and Edward Pinto

Sources: Inside Mortgage Finance, FHFA, Fannie Mae, Freddie Mac, and Edward Pinto

The above analysis makes it clear that the GSEs’ subprime acquisitions exceeded subprime PMBS issuances and that their dominance predates the dramatic rise of the subprime PMBS market in 2004.

I was able to trace the GSEs’ purchases of subprime loans and securities as far back as 1997. They purchased $66 billion in subprime PMBS during the period 1997-2001. They also purchased $419 billion of subprime loans not initially classified as subprime during the same period 1997-2001.

The GSEs’ subprime purchases totaled $2.2 trillion over the 1997-2007 period.

I look forward to Mr. DeMarco’s confirmation or correction of my research.