Did Washington Push Banks to Make Bad Loans?

Conservatives claim the fundamental cause of the financial crisis was excess lending to poor people. But does this view hold up in the crisis panel report?

Conservatives claim the fundamental cause of the financial crisis was excess lending to poor people. But does this view hold up in the crisis panel report?

Let’s face it: You won’t read every page of the Financial Crisis Inquiry Commission report. But FrumForum will, over the next days. So let’s proceed together, page by page, identifying the key points.

Click here to read the entire series.

Pages 72-80 of the Financial Crisis Commission cover the most contested ground of the financial crisis: the Community Reinvestment Act.

It's an article of faith among conservatives that the fundamental cause of the crisis was excess lending to poor people and minorities.

It's equally an article of faith among liberals that the lending had little if anything to do with the crisis.

The conservative view faces 2 powerful counter-arguments:

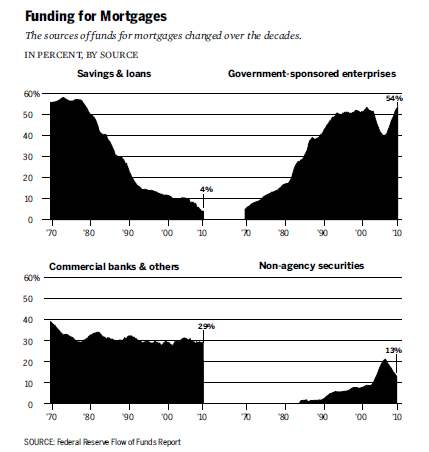

(1) after the year 2000, the real driver of subprime lending was the non-bank sector, not subject to the CRA; and

(2) the subprime market was just too small to tank the US financial sector. Sub-prime lending only became a threat when sub-prime loans were packaged into derivatives. The CRA did not require anyone to do that.

But the liberal view also faces a counter-argument:

Sub-prime loans were the stuff of which the toxic derivatives were made, and it was not some idle whim or fancy of the bankers that led to the proliferation of sub-prime loans.

For example, it was the pressure of the CRA that led to the invention of the concept of the "credit score" so as to diminish the discretion of lending institutions. Credit scores in turn became a driver of the expansion of credit to ever less creditworthy borrowers.

From page 74:

Former comptroller John Dugan told FCIC staff that the impact of the CRA had been lasting, because it encouraged banks to lend to people who in the past might not have had access to credit. He said, “There is a tremendous amount of investment that goes on in inner cities and other places to build things that are quite impressive. . . . And the bankers conversely say, ‘This is proven to be a business where we can make some money; not a lot, but when you factor that in plus the good will that we get from it, it kind of works.’”

Lawrence Lindsey, a former Fed governor who was responsible for the Fed’s Division of Consumer and Community Affairs, which oversees CRA enforcement, told the FCIC that improved enforcement had given the banks an incentive to invest in technology that would make lending to lower-income borrowers profitable by such means as creating credit scoring models customized to the market. Shadow banks not covered by the CRA would use these same credit scoring models, which could draw on now more substantial historical lending data for their estimates, to underwrite loans. “We basically got a cycle going which particularly the shadow banking industry could, using recent historic data, show the default rates on this type of lending were very, very low,” he said. Indeed, default rates were low during the prosperous 1990ss, and regulators, bankers, and lenders in the shadow banking system took note of this success.

The pre-1980 mortgage market was dominated by local lenders. It was highly discretionary, which enabled discrimination - but also required bankers to weed out bad risks at origination. The savings & loan crisis killed the old mortgage market.

George Bailey of It's a Wonderful Life retired from mortgage lending forever. In the new anonymous securitized market, high-flown liberal egalitarian ideals became the material out of which self-interested and consequence-indifferent financial engineers built the biggest economic bomb since World War II.

More to come...

Tweet