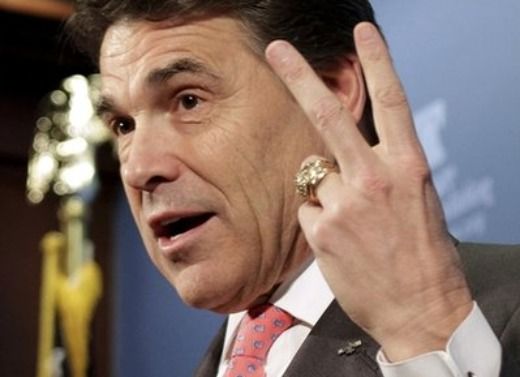

About that Perry Jobs Plan

The governor's jobs plan is to open more of the US to energy exploration and production.

He promises that such a policy will create 1.2 million new jobs. When I heard this, it seemed to me utterly implausible: the US oil and gas industry employs 2.1 million today, coal under 100,000 - and these at a time of high prices and active production. 50% more jobs on top of that? In a capital-intense industry?

Michael Levi of the Council on Foreign Relations checked Gov. Perry's math on the Atlantic website. Here's what he found:

1) The promise of 1.2 million new jobs is subject to a deadline of ... 2030! These are not new jobs that would be created in the here and now, but over a long timeline of future production.

2) The promise is also subject to a bold prediction that energy prices, high now, will rise even higher over the next 18 years, oil to $180 / barrel in today's money, natural gas to $12 per thousand cubic feet. That might happen, but then again, it might not. After all, Perry is hoping for a big increase in energy supply. Remember what happens to price as supply rises?

3) The plan rests upon heroic assumptions about the multiplier effect of oil and gas jobs. Fewer than 400,000 of Perry's 1.2 million promised jobs will take the form of new hires by the oil and gas industry. The great balance are supposed to come from the - ahem - stimulative effects of oil and gas production. Specifically, he assumes that every 1 new job in production will support 2.5 new jobs somewhere else.

But wait a minute. The precondition for the entire estimate is an assumption that energy prices more than double in real terms over the next 18 years. If that assumption holds, we're going to see a reverse-multiplier effect, with higher energy prices destroying many more jobs than are produced by oilworkers spending their money at the mall.

In other words: Perry's 1.2 million figure is not a net figure. If he's right about the energy outlook, then his 1.2 million new energy-related jobs will hardly begin to offset a much larger number of energy-related job losses.

4) The biggest kicker of them all comes from this question: how new are Perry's jobs really? Suppose we don't elect Rick Perry president. Suppose we just continue on the present policy path. What happens to those 1.2 million jobs in that case? And the answer is: many of them show up anyway. Perry hypothesizes that the Obama administration will impose future regulations to inhibit the development of the gas-fracking industry in the US - and then counts as "new" jobs the jobs that would come by not imposing those as-yet-nonexistent regulations. Likewise he counts as "new" jobs the jobs that would come from approval of pipelines to Canadian oil sands. Yet those approvals are roaring ahead anyway.

Last thought:

Where'd Perry get these numbers?

Answer: he found them in a pre-existing study conducted for the American Petroleum Institute. (That same study also undergirds the Senate Republicans' job plan.)

You've got to ask though: if a candidate's entire jobs plan depends on taking a single industry's policy wish list, tearing off the cover sheet, and putting his own name on the work, without even bothering to net out the costs and benefits for the whole US economy - how serious is that candidate?

As we've seen throughout the Perry campaign the answer is: not very.